Through an important analysis of the years from 2016 to 2020, we were able to prove – once again – the efficiency and power of our tool: The Best Price. This is able to establish the best price for every property.

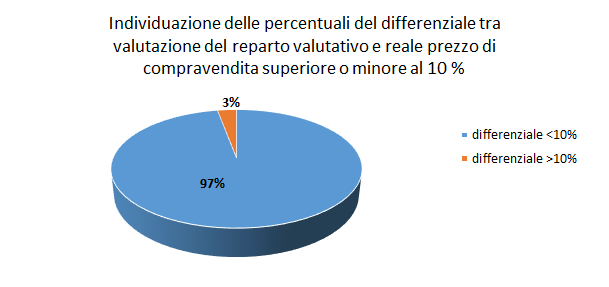

On 332 properties (with a bought and sold value of about € 300 million and an average of about € 900.000), 322 (the 97% of cases) reported a difference between the estimate of the estimating team and the real value of less than 10%, with an average differential over the five-year period of 5.3%, which has even improved to an average of only 3.6% in 2020:

AN ABSOLUTELY EXCELLENT FIGURE!

A great result that confirms how this innovative tool, on which the entire GE Group has been working for over 5 years, has achieved exceptional performances, proving to be one of the few highly performing valuation systems in Italy for the purpose of identifying the correct market value of properties in the “luxury” range.

In recent years, many property valuation systems have emerged within the real estate market. However, a very few of these are specifically addressed to the luxury property market: THE BEST PRICE fills this important gap.

Here are some pictures of some of the properties that have been bought and sold and that are the subjects of this analysis. If you want to see them all, click here.

The objective of our analysis

In our analysis, we looked at Great Estate’s sales over the last five years – 2016 to 2020 – as well as over the sales that Great Estate had been working on, and the sales of which that Great Estate was aware.

Therefore, the objective of this work is to verify the differential between REAL ESTATE PROPERTY PRICES, resulting from the entire real estate market analyzed, and REAL ESTATE VALUATIONS entered by the various professionals in our Realgep management system, in order to assess the performance of our innovative IT tool, THE BEST PRICE.

The methodology of THE BEST PRICE system

Identifying the best value of a property is the first important basis to make the right decisions, and therefore achieving the best result in marketing every property, whether you want to sell or buy your dream home.

The procedure used by THE BEST PRICE was devised by professionals from various university backgrounds, IT specialists, real estate experts, and experienced analysts in business development and management.

All these professional skills have made it possible to create a system that allows the identification of the best market value of every property, through a careful and innovative analysis of a series of quantitative and qualitative data, examined both while entering and analyzing through the use of various algorithms.

The municipality, surface area, number of rooms, presence of additional elements – such as a garden, agricultural land, or a swimming pool – and over 40 qualitative characteristics, are just some of the data that go to make up the various algorithms through which a score is assigned to the quality of the property. By means of this algorithm, by mixing surfaces, quality, and many other data, the property being estimated is compared with the statistical data of the past market, with all that the real estate market offers in terms of asking prices, valuations, and, above all, with the real sale prices realized. This quantitative and qualitative data is mixed by using powerful and tested algorithms.

The first step is for the individual professional to draw up an estimate, which is then verified by our valuation department.

Among the group’s next projects is the one of allowing you, as a seller or buyer, the possibility of drawing up estimates independently. So, in fact, we will have three levels of accuracy of the valuation itself, namely:

- VALUATION MADE THROUGH THE BEST PRICE DIRECTLY BY THE OWNER OR CUSTOMER CONCERNED.

This innovative possibility will allow you, as an owner, or you who want to buy a property in a careful and prudent way, to use the same intelligence used by every professional of Great Estate: THE BEST PRICE. Obviously, we have already considered that, whether you are a buyer or seller, you will find yourself, for the first time or the first few times, entering important data, both quantitative (property area and its differentiation, or the inclusion and valuation of annexes) and, above all, qualitative (every owner tends to attribute more quality to his/her property than the real one), and using an absolutely structured program.

However, the use of a series of internal algorithms allows the system to set or advise on the best way of entering all these data: therefore, even the least experienced client will be able to achieve a more than satisfactory result, so as to obtain without any doubt a more objective data with respect to his own valuation idea.

- VALUATION DRAWN UP BY THE REAL ESTATE AGENT

All our agents constantly undertake specific professional courses in order to improve their skills in the knowledge and use of our THE BEST PRICE, as their specific activity, their “task” is to be able to sell the property, and not to estimate it “professionally”.

- EVALUATION BY ONE OF THE PROFESSIONALS FROM OUR IN-HOUSE EVALUATION DEPARTMENT.

This is the highest level of accuracy in an estimate. It can be achieved through a perfect mix of expertise and IT tools. Our valuation department is made up of various professionals including Engineers, Surveyors, and Architects with very high skills, who use our system 8 hours a day and often more.

So COMPETENCE + THE BEST PRICE + EXPERIENCE = EXCELLENT RESULTS (exactly those analyzed in this article).

We would like to specify that the above-mentioned estimates, regardless of who is going to carry them out, can be done either remotely or during or following a visit to the property.

In fact, during the last year, 85% of the estimate carried out “online” by our estimate department, i.e. without a physical visit but with a careful study of the photos, floor plans and location, by means of visits with Google Heart and an interview with the seller client, immediately showed surprising results, which were then substantially confirmed during the subsequent on-site visit of the property by our appraisers.

The methodology used for our analysis

The analysis we carried out is based on the data provided by the REALGEP software on properties listed or bought and sold by the professionals of Great Estate from 2016 to 2020.

The valuation scenario offered by the system is very reliable, since the results obtained take into account data made available by various national bodies (such as the Italian Real Estate Observatory and the Italian Revenue Agency), BIG DATA provided by real estate portals, and, above all, data from sales concluded by GE professionals, as well as those made by private individuals or other agencies, concerning properties that the group of professionals or valuers have entered in REALGEP before, or even after, they have been marketed.

Thanks to this important data, THE BEST PRICE returns 3 different valuation scenarios.

The first comes from a comparison with O.M.I. data; the second, from a comparison with properties for sale on the market; the third from a comparison with estimates and sales made and/or entered and certified by the Network’s professionals.

The most reliable valuation scenario is the one based on a comparison with the properties estimated and sold, as “certified” by Great Estate: unlike for the first two, in this third scenario, high-quality data are used, while in the first two, data are quantitatively important, but of lower quality.

Unlike the first two scenarios, which represent the main sources used by the majority of the tools available on the market, and which may seem similar to THE BEST PRICE, the third valuation scenario constitutes the true COMPETITIVE ADVANTAGE of THE BEST PRICE, since the result obtained derives from the careful and correct entering of every single piece of data for each property, both in terms of quantity and quality.

This peculiarity allows not only a perfect comparison analysis but also a constantly updated one. In fact, both estimates and sales are daily updated and entered by the group’s professionals: so this third scenario shapes and adapts, immediately and constantly, to any changes perceived by the market.

Among the next developments planned by the Great Estate Group is also the one of studying of a method to anticipate market trends, and therefore also the next valuation scenarios.

Results and analysis

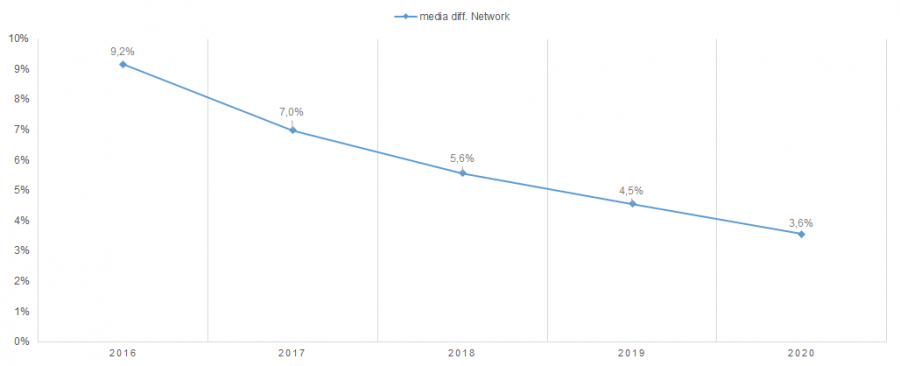

The results achieved in the five-year period 2016-2020 show an average differential between the REAL SALE PRICE and the estimated valuation of 5.3%, with a constant improvement over the years until reaching an excellent 3.6% in 2020. They represent an extraordinary confirmation of how THE BEST PRICE, together with EXCELLENT SKILLS AND EXPERIENCES, is undoubtedly one of the best tools for establishing estimates of every type of property on the Italian market, with particular attention to the prestigious properties, which is not exactly usual within the market itself.

WE NOW TURN TO COMMENTS ON THE ANALYSES CARRIED OUT, BROKEN DOWN BY HOMOGENEOUS GROUPS OF PROPERTIES.

FIRST ANALYSIS:

PROPERTY WITH A DIFFERENTIAL BETWEEN APPRAISAL DEPARTMENT VALUATION AND ACTUAL SALE PRICE OF 10% OR LESS.

The first analysis carried out is that of the 322 properties sold, out of 332 analysed, which revealed a differential between the valuation of our valuation department and the actual sale price of less than 10% (each graph identifies a different analysis):

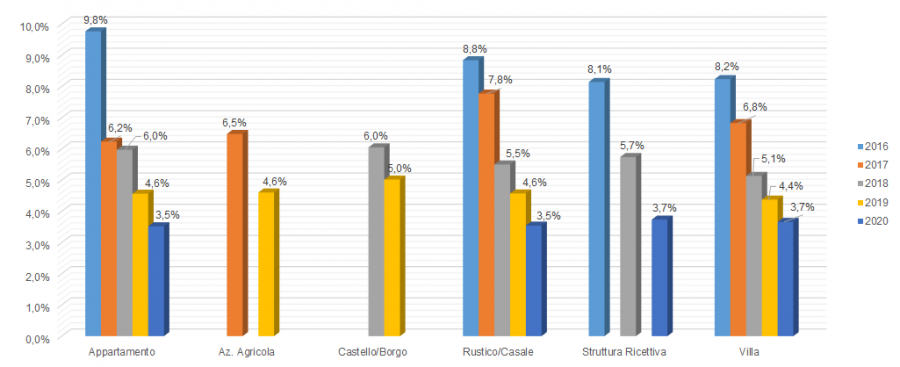

The average differential between the actual sale prices and the valuations by type (Apartment, Farm, Castle/Building, Rustic/House and Villa), as shown in Graph 1, is generally always decreasing for all types, with a maximum value of 9.8% (reached in 2016 for the Apartment type) and a minimum value of 3.5% (reached for the Apartment and Rustic/House types).

The graph above shows how, over the years, the performances of THE BEST PRICE have steadily improved. This is the normal consequence of a great deal of work done in relation to the following activities:

- Increase in the number of properties entered, both in terms of valuations and sale/purchase data.

- Increase in the quality of the data entered.

- Improvement of the “weights” of the different qualitative characteristics affecting the various algorithms that allow THE BEST PRICE system to create the various valuation scenarios. We specify that these “weights” and the related “qualitative characteristics”, or “mix of qualitative characteristics”, change value according to zones, price ranges, types, and many other variables. This makes THE BEST PRICE always and constantly aligned not only with the TIME factor but also with the QUALITY factors that identify each individual property.

So, analyzing the differential averages Network by year (graph 2), we note a constant downward trend that takes the first figure, 9.2% in 2016, to the last one of 3.6% in 2020, demonstrating how THE BEST PRICE is really performing and reliable.

On a property valued at € 1 million, the statistical differential in 2020 predicts that it will be bought and sold for between € 967,000 and € 1,036,000: it is objective that these differences are minimal, further confirming the extraordinary performance of the system.

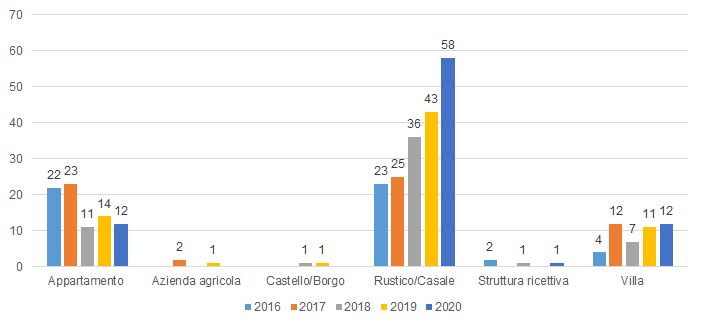

As shown in Graph 3, the property types covered by this first analysis are Flat, Farm, Castle/Building, Rustico/Casale, Accommodation, and Villa.

We specify that the Apartment and Villa types are divided into three sub-types, namely:

- Flat: Apartments, Apartment in Old Town, Luxury Apartment.

- Villas: Luxury villa, Detached villa, Multi-family villa.

Over the years, our group has concentrated more on farmhouses and villas in the countryside, while the number of sales of flats has decreased and the number of sales of farms, castles and hamlets and accommodation has remained fairly constant.

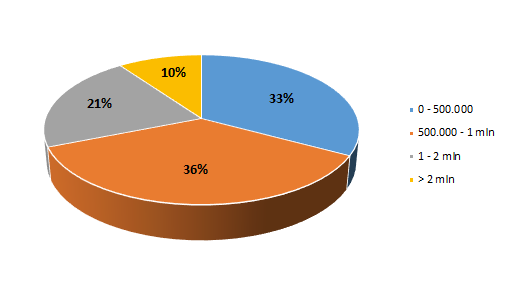

109 properties were in the price range below € 500,000, 120 were sold between € 500,000 and € 1 million, 70 in the range 1 – 2 million, and 33 were sold for more than € 2 million.

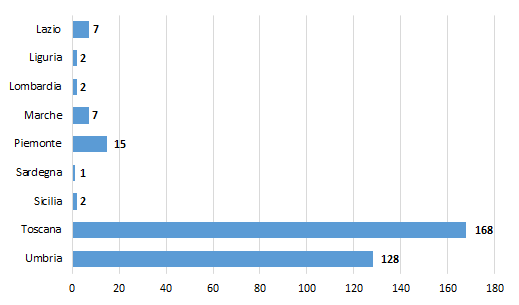

The regions most analysed are Tuscany and Umbria, where the group currently has its greatest presence.

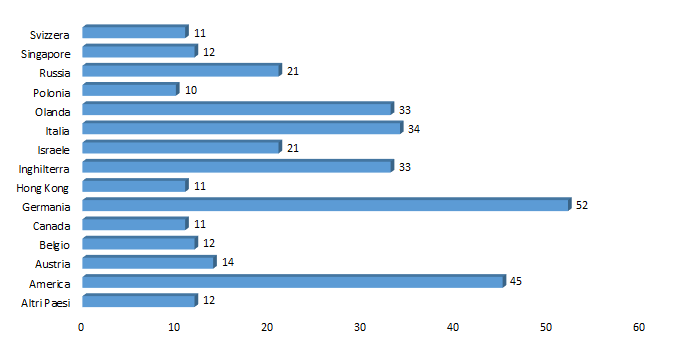

This last graph confirms that the majority of buyers of objectively important properties are foreigners. Specifically, about 10% of property buyers are Italian while 90% are from foreign countries.

SECOND ANALYSIS:

PROPERTIES WITH A DIFFERENTIAL BETWEEN VALUATION DEPARTMENT VALUATION AND ACTUAL SALE PRICE GREATER THAN 10%.

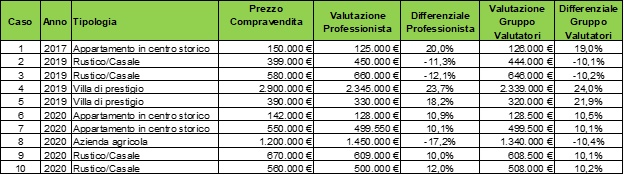

In this second analysis we have commented on the reasons why, for 10 properties, the differential between the actual sale price and the valuation was higher than 10%.

Given that the data that emerges from the overall analysis leads to a percentage of 97% of properties sold with a differential between valuation and an actual sale price of less than 10%, an exceptional result resulting from a mix of skills, perseverance, and foresight, However, in the real market, in a very few cases (statistically less than 5%) there may be reasons that certainly influence a result that leads to a differential between valuation and an actual sale price of more than 10% (e.g. complementary values, interest in buying that property and only that property, or the need to sell that property).

However, as our analysis shows, these are exceptions (for us 3%):

the rule is that, in 97% of cases, the actual sale price corresponds to the valuation, with minor deviations that can be either over or under.

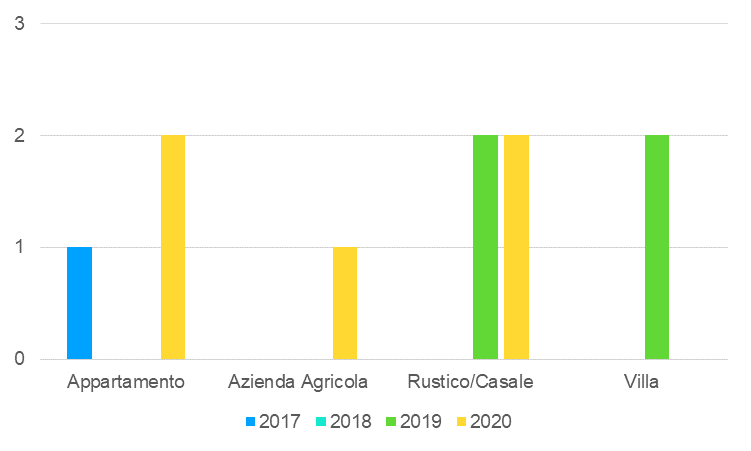

This graph shows that the properties subject to this second analysis, with a differential between valuation and actual sale price greater than 10% are: three Apartments (one sold in 2017 and two in 2020), one Farm (sold in 2020), four Rustico/Casale (two sold in 2019 and two in 2020) and two Villas (sold in 2019).

The table below shows the Agent and Network differentials for the ten properties. We analyse the individual cases:

CASE 1:

The price of the flat sold in 2017 was higher than the valuation because it included the furniture of high antiques, amounting to approximately € 30,000.

The valuation of the professional was € 125,000 and the actual sale price was € 150,000. If the value of the furniture (about € 30,000) had been included, the differential would have fallen to 3.2%.

The valuation of the valuation department was € 126,000 and the actual sale price was € 150,000. If the value of the furniture (about € 30,000) had also been included, the differential would have fallen to 3.8%.

In fact, it would have been correct to include this case among those with a differential of less than 10% but, for the sake of linearity of the data entered, we thought it appropriate to record it here.

__________________________________________________________________________________________________________________________

CASES 2 and 3:

The final prices of the cottages/houses sold in 2019 were lower than the valuation of the individual professional because, in both cases, the owner decided to sell as soon as a concrete offer became apparent.

__________________________________________________________________________________________________________________________

CASE 4:

Regarding the prestige villa sold in 2019, located within the property of a famous luxury hotel, the owner decided to buy at a price higher than the valuation of approximately 24%, so as to avoid the takeover of the hotel complex by third parties.

Case 4 confirms the concept of COMPLEMENTARY VALUE, a case that can absolutely occur in the market.

__________________________________________________________________________________________________________________________

CASE 5:

Concerning the other prestige villa sold in 2019, the actual sale price was higher than the professional’s estimate because the construction of the swimming pool, to be paid for by the seller, was required at a value of approx. € 40,000.

The valuation of the professional was € 330,000 and the actual sale price € 390,000. If the value of the swimming pool, about € 40,000, had been included, the differential would have fallen to 5.4%.

The valuation of the valuation department was € 320,000 and the actual sale price was € 390,000. If the value of the swimming pool had also been included, which was approximately € 40,000, the differential would have fallen to 8.3%.

The same considerations as in case 1 also apply here.

__________________________________________________________________________________________________________________________

CASE 6:

The final sale price of the first flat sold in 2020 was higher than the value respectively estimated by the individual professional and the valuation department because it included the garage (worth approximately € 17,000), which was not present at the time of the initial valuation.

The professional valuation was € 128,000 and the actual sale price was € 142,000. If the value of the garage, at approximately € 17,000, had also been included, the differential would have fallen to 2.0%.

The valuation by the valuation department was € 128,500 and the actual sale price was € 142,000. If the value of the extension of about € 17,000 had been included, the differential would have fallen to 2.4%.

The same considerations as in case 1 also apply here.

__________________________________________________________________________________________________________________________

CASE 7:

The final sale price of the second flat sold in 2020 was higher than the value estimated by the individual professional and the valuation department respectively because the value of the furniture and fittings (amounting to approx. € 60,000) was included.

The valuations of the professional and the valuation department are almost the same, € 499,550 and € 499,500 respectively. The actual sale price is € 550,000.

If the value of fittings and furniture, amounting to some € 60,000, had also been included, the differential for both the professional and the valuation department would have fallen to 1.7%.

__________________________________________________________________________________________________________________________

CASE 8:

The wine estate sold in 2020 realized a final price that was a good 10.4 percentage points lower than the valuation. This was due to the fact that, after several years of in vain presence on the market, due to both marketing difficulties and market trends relating to this particular and complex type of property, the owner decided to sell as soon as a concrete offer became available.

__________________________________________________________________________________________________________________________

CASE 9:

Concerning the first rustic/house sold in 2020, an extension of about 50 sqm of the property (worth about € 65,000) was included in the sale: as a result, the actual sale price was higher.

The professional valuation was € 609,000 and the actual sale price was € 670,000. If the value of the extension, about € 65,000, had been included, the differential would have fallen to 1.4%.

The valuation of the valuation department was € 351,000 and the actual sale price was € 670,000. If the value of the extension, about € 65,000, had been included, the differential would have dropped to 0.5%.

The same considerations as in case 1 also apply here.

__________________________________________________________________________________________________________________________

CASE 10:

The sale of case 10 occurred in the first phase of the Covid-19 pandemic, representing the result of the buyer’s desire to buy at all costs a property with outdoor space: this, allowed to define the negotiation at a sale price of 10 or 12 percentage points higher than the value estimated respectively by the valuation team and the professional. We can say that this was a unique case, out of about a hundred sales made by the group in 2020, and therefore truly … a case.

CONSIDERATIONS:

The first consideration to be made is that among the 10 sales that showed a differential between the estimate and the real sale price of more than 10%, 5 of them were influenced by added values such as furniture and/or works carried out by the selling party; values that could not be included in the first evaluation phase.

It is therefore clear that, realistically, from 10 sales with a differential of more than 10%, we have to go down to 5, and that behind each of them there has always been an important motivation, linked more to the needs of the parties than to a real evaluation resulting from a perfect market.

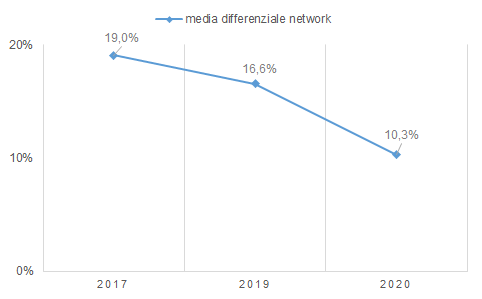

In Graph 8 we can see that, even for properties with a valuation/real sale price differential greater than 10%, the latter has steadily decreased over the years, confirming once again how well our THE BEST PRICE tool performs.

Conclusions

This important analysis took into account a significant number of properties objectively bought and sold on the market and/or by the Great Estate Group in the years between 2016 and 2020. In addition, the differentials, in percentage terms, between the actual sale price and the value estimated by the valuation team using THE BEST PRICE were carefully analyzed.

The results obtained are absolutely extraordinary and allow us to state with certainty that THE BEST PRICE represents a tool that offers powerful performance for the valuation of any real estate property, and which has shown constant improvement over the years. It has shown constant improvement over the years, achieving performance that shows very little room for improvement, particularly in determining the best valuation of luxury properties.

We can state with solid certainty that THE BEST PRICE, combined with the professionalism of the valuation department and the significant amount of high-quality data within the system used by the Great Estate Group (REALGEP), guarantees absolute awareness and objectivity in the valuation of prestigious properties.

For you, who want to sell or buy a prestigious property, being able to use such a powerful tool as The Best Price is undoubtedly a great PLUS, thanks to which you can make the best possible decision in your own interest.

Present your prestigious property to international buyers.

Great Estate offers you a proven and effective method, innovative tools for the evaluation and analysis of your property, and the complete professionalism of consultants specialised in the prestigious property sector, with over 25 years of experience in international sales. Entrust your sale to safe hands and discover all the services dedicated to you.