How to maximise profit from the sale of your property? Analysing examples based on actual sales, the do’s & don’ts to develop a winning positioning strategy.

This guide completes the in-depth study ‘The right price to demand when selling your property’, with practical examples and tips on what to do and what not to do to place a property for sale and get the maximum benefit.

You have decided to sell your property: what is the right price to request?

First of all, we should clarify: we define ‘value’ as the amount that can be required from the market for your property, while ‘price’ means the amount actually paid at the time of the sale. In the previous insight, we talked about how the value you place on a property can be influenced by several factors, we recommend reading it before moving on. In the following, we will show you through practical examples the different results obtained in two sales, with or without the application of a correct positioning strategy.

Recurring example: the owners’ personal appraisal exceeds the objective appraisal by more than 20%.

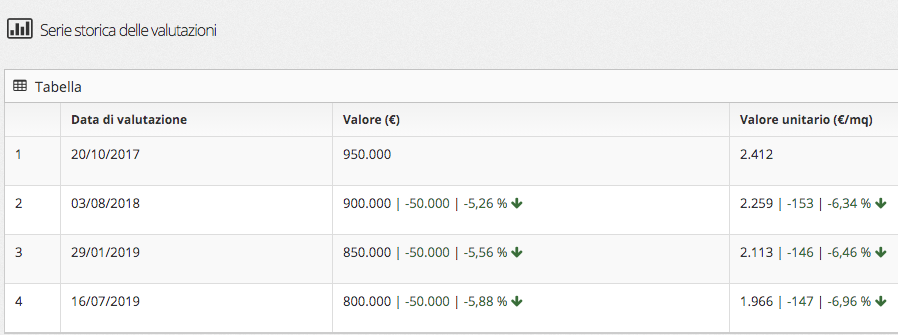

The graphs below show the historical valuation series and price history for a farmhouse sold by our group in 2019.

- The appraisal carried out by The Best Price system of Great Estate, in 2017 assigned a value of €950,000 to the farmhouse;

- The owner chose to place the property on the market at a value of €1,350,000 (+ 47% compared to the appraised value);

- The farmhouse has been on the market for 30 months, in the meantime the appraised value has suffered a gradual drop also in relation to market fluctuations;

- The sale took place in 2019 at € 800,000 ( – 15% compared to the appraised value).

This example demonstrates specifically what advantages and disadvantages were caused by the decision to place the property for sale with a price 20% higher than the valuation.

Advantages

None for the owner.

Numbers show how subjective value can negatively affect the outcome of a sale. To believe that there is such a thing as a buyer ‘falling in love’ with the property, and therefore willing to invest whatever the owner demands, is the worst approach to the sensitive positioning process: more than a strategy, it is an illusion that leads to financial suicide.

Of course, people who decide to buy valuable assets such as a prestige property also do so motivated by the fascination exerted by the beauty of the place, the landscape, the atmosphere, and therefore any customer who buys a property falls in love with it. But, besides love, the buyer’s choice is also driven by the perception of making a good investment. After the emotion of the first visit, a more rational approach takes over, supported by sources of information which, thanks to digital media, are within everyone’s reach: the comparison with other properties on other portals, the calculation of ancillary expenses, the level of maintenance and renovation of the property, the thoroughness of the documentation found.

Positioning a property today at a market value means communicating immediately to potential buyers that it is an advantageous investment, distinguishing it from most of the offers available.

Disadvantages

Here is what happens to those who approach selling without a rational strategy.

- Seeing the property value decrease year after year.

- Continuing to invest in looking after the image and decorum of the property, or stopping doing so and causing a further loss in value.

- Believing, or rather deluding oneself, that a certain budget is available (in the example, more than EUR 1 million), when in reality the final revenue will be much lower.

- Keeping the property on the market for too long, resulting in a loss of image that generates mistrust in potential buyers.

- Selling off the property, progressively reducing its value to the point of creating in those interested the expectation of a further decline.

- Negotiating downwards: the few willing to buy, having access to information on price changes over time, will be suspicious and unwilling to match the asking value and may submit an even lower offer.

95% of the properties on the market are unsold mainly for this reason: the subjective value assessed by the owner, often without any specific expertise, exceeds the objective estimate drawn up by professionals by more than 20%.

Case in point: a correct positioning strategy

This example shows the valuation and asking value graphs for a property in Città della Pieve sold in 2018 by the Great Estate group to British buyers.

In questo esempio sono riportati i grafici relativi alle valutazioni e al valore richiesto per una proprietà di Città della Pieve venduta nel 2018 dal gruppo Great Estate ad acquirenti britannici.

- The valuation carried out by The Best Price system of Great Estate, in 2018 assigned the farmhouse a value of 900,000 € ( not too different from that in the previous example);

- The owner chose to place the property on the market at a price of €1,00,000 (+ 10% compared to the appraised value);

- The house was on the market for only 4 months;

- During the negotiation, the purchase price was negotiated at 900,000 €, exactly the same as the value attributed by the appraisal.

This second example, in which the owner decided to offer the property for sale with a price very close to that estimated by the valuation, demonstrates the advantages of a correct positioning strategy.

Disadvantages

None.

It may seem that the owner ‘lost’ the difference between their subjective value and the asking price, but the latter corresponds exactly to the objective value of the property. Compare this example with the previous one and it will quickly become clear to you which of the two was the better strategy: according to the valuation, both owners had the potential to cash in between 900,000 and 950,000 euro, the first property was depreciated by 30 months plus maintenance costs, the second was sold for the right price in just 4 months.

Advantages

1) Sell at the best price before the value of the property starts to decrease year after year.

2) Continue to invest for just a few months in the maintenance and taxation costs of the property.

3) Have a budget very close to what is expected, in the example €900,000 paid in the same year.

4) Having surprising market power, offering buyers the prospect of a real bargain, since so many other similar properties are objectively overpriced.

5) An upward negotiation: the few interested buyers, having access to data comparing different properties for sale, noticing a value in line with the market will be encouraged to act as quickly as possible so as not to miss the opportunity.

6) A good reputation given by asking for an honest and fair value, showing self-respect and respect for the prospective buyer.

These are the benefits that can be gained by relying on a professional, objective and transparent method to strategically place your property. This is demonstrated by our customers themselves, who share their views on this purchase in the interview with the former owner of the farmhouse ‘La Quercia Illuminata’.

Still willing to put your property up for sale at the highest price? Find out more about our dedicated seller services and The Best Price valuation system: visit the site or contact your trusted Great Estate advisor.

Present your prestigious property to international buyers.

Great Estate offers you a proven and effective method, innovative tools for the evaluation and analysis of your property, and the complete professionalism of consultants specialised in the prestigious property sector, with over 25 years of experience in international sales. Entrust your sale to safe hands and discover all the services dedicated to you.

Read also: